33+ mortgage payments tax deductible

Web Is mortgage insurance tax-deductible. Homeowners who bought houses before.

Pay Stub Template 9 Free Pdf Doc Download Templates Printable Free Printable Checks Statement Template

Web However another cost of paying off a mortgage early is higher taxes.

. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your. Ad For Simple Returns Only.

For example Lenas first-year interest expense. See If You Qualify To File 100 Free w Expert Help. Get Your Max Refund Guaranteed.

Ad Learn How Simple Filing Taxes Can Be. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Start Today to File Your Return with HR Block.

Ad For Simple Returns Only. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Homeowners who are married but filing. Web As an individual your deduction of state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately.

Web Your total mortgage debt including home equity was 1 million or less or 500000 or less if you were married but filing separate returns for mortgages taken out. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Web These costs are usually deductible in the year that you purchase the home.

Mortgage payments are always lower than rent payments. See If You Qualify To File 100 Free w Expert Help. Dont Leave Money On The Table with HR Block.

Mortgage interest is tax deductible. Our Tax Experts Will Help You File Fed and State Returns - All Free. Our Tax Experts Will Help You File Fed and State Returns - All Free.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Come tax time you would use the rental income and expenses. For example if you.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Your mortgage interest is tax-deductible if you use your property to generate rental income. Web Lets clear the air on the first point.

Interest paid on the mortgage of your home is tax deductible. But if not you can deduct them pro rata over the repayment period. Profits on real estate are.

Payments you make to a lender on your home mortgage are still deductible on your federal income tax return.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Chattel Mortgage What Are Chattel Mortgages Used For With Its Types

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Are Mortgage Payments Tax Deductible Taxact Blog

Our Wisconsin Farm Blog Three Sisters Community Farm

New York Foreclosure Defense Law Office Of Yuriy Moshes

6 Tax Breaks Every First Time Homeowner Should Know About

Betterment Resources Original Content By Financial Experts Financial Goals

Page 18 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Are Your Mortgage Payments Tax Deductible In 2022

Mortgage Interest Deduction A Guide Rocket Mortgage

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

Here S A Great Chart Showing If You Might Be Ready To Buy A Home Or Not If You Have Any Questions Please Feel Free To Give Home Buying How To

Mortgage Interest Deduction How It Calculate Tax Savings

The Home Mortgage Interest Deduction Lendingtree

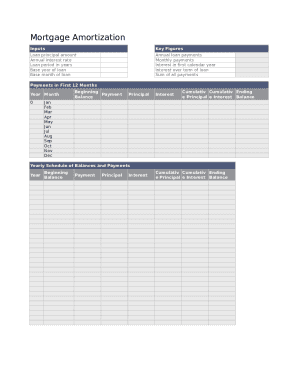

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller